In the context of the US applying higher tariffs on imported goods, businesses need to prepare scenarios to respond to tariffs, by making contingency financial plans, calculating the impact costs of tax scenarios to prepare reserve capital, and restructuring costs.

Electronic products account for 34.9% of total export turnover to the US in 2024

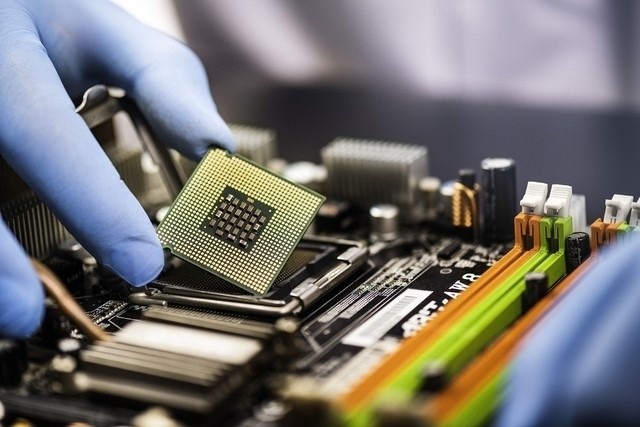

In the Vietnamese economy, the electronics industry plays an important role, accounting for 17.8% of the total industrial value and putting Vietnam in the top 15 largest electronics exporting countries in the world.

According to data from the Vietnam Electronics Business Association, in 2024, electronics export turnover will reach more than 126.7 billion USD, accounting for more than 30% of the country's total export turnover, up 10% over the previous year.

In terms of production structure, Vietnam's electronics industry mainly focuses on manufacturing electronic and optical products.

However, Vietnamese enterprises are mainly small and medium-sized enterprises, participating in low-cost assembly stages, and are heavily dependent on China (30-80% depending on the industry).

At the M-TALKS 2025 Manufacturing Industry Forum with the theme "Innovating the future of Vietnam's electronics manufacturing industry: Applying artificial intelligence (AI), automation and integrating into the global supply chain" recently held, Ms. Do Thi Thuy Huong, Executive Committee Member of the Vietnam Electronics Enterprises Association, said that the US is Vietnam's largest export market, accounting for about 29% of total export turnover.

Of which, the electronics industry has an export proportion to this country of up to more than 40% in some segments.

Among the main export groups of Vietnam to the US in 2024, electronic machinery and equipment, recording equipment will reach 41.7 billion USD, accounting for 34.9% of Vietnam's total export turnover to the US.

Assessing the impact of the US raising tariffs on imported goods from Vietnam on the electronics industry, Ms. Huong said that high tariffs from the US can increase production costs for Vietnamese enterprises.

Increased raw material prices, increased production costs, affecting the profits and competitiveness of enterprises; Tariffs can increase logistics costs for businesses...

Regarding the impact of the US raising tariffs on imported goods from Vietnam, at the press conference announcing socio-economic statistics for the second quarter and the first 6 months of 2025 held on July 5, the General Statistics Office, Ministry of Finance, presented 3 scenarios to assess the impact of the US's reciprocal tariffs on Vietnam's economic growth.

At the same time, the representative of the General Statistics Office also mentioned the export industries that could be affected by reciprocal tariffs. Accordingly, electronic components, phones, computers, etc. are among the industries that have decreased sharply with a calculated decrease of about 4 percentage points.

In that context, to cope with fluctuations from changes in US tax policies, the General Statistics Office proposed that Vietnam should have measures to encourage investment, diversify export markets, exploit the domestic market and improve the business environment.

Enterprises need to restructure production, increase added value

According to the representative of the Vietnam Association of Electronic Enterprises, in the current context, difficulties are also opportunities for Vietnam to restructure the supply chain, promote digital transformation and expand the market through free trade agreements (FTAs) and cross-border e-commerce.

Ms. Do Thi Thuy Huong, Executive Committee Member of the Vietnam Association of Electronic Enterprises, shares solutions to respond to reciprocal tax policies

To adapt to the US tariff policy, Ms. Do Thi Thuy Huong recommends that enterprises also need to increase short-term contract negotiations, take advantage of the low-tax period; seek cost-saving transportation solutions such as cooperating with large shipping lines or using low-cost transit ports to reduce cost pressure in case of tax increases.

At the same time, prepare scenarios to respond to tax levels, by making a financial backup plan, calculating the impact costs of tax scenarios to prepare reserve capital, restructure costs or negotiate loans with preferential interest rates.

Along with that, maintain close contact with the Ministry of Industry and Trade, industry associations to grasp information, policies, participate in trade promotion programs; diversify export markets, take advantage of 17 FTAs that Vietnam has signed with nearly 70 economies, to reduce dependence on the US market.

Accordingly, businesses can research potential markets such as India, the Middle East or Africa; invest in market research and build brands in new markets.

An important solution is that businesses also need to restructure production and increase added value. Accordingly, it is necessary to invest in green technology and products, and transform production towards sustainability such as using renewable energy and environmentally friendly materials to meet the strict standards of the US and developed markets; this will also help increase competitiveness if the US imposes additional non-tariff barriers.

In addition, businesses need to promote the production of high value-added products such as semiconductor components